Businesses are processing payroll the same old-fashioned way for as long as we can remember. For over 50 years, employees have received their pay in a fixed period set by their employer… yet, the world is continuously changing. Consumer behaviour has shifted dramatically with the explosion of our on-demand society but our employees continue to wait for weeks or even months to get paid.

In this world of instant gratification and on-demand consumption, people have bills due on a regular basis. As a result, our current payroll processes no longer work for society. Moreover, this outdated and broken system is creating many unnecessary issues and costly mistakes.

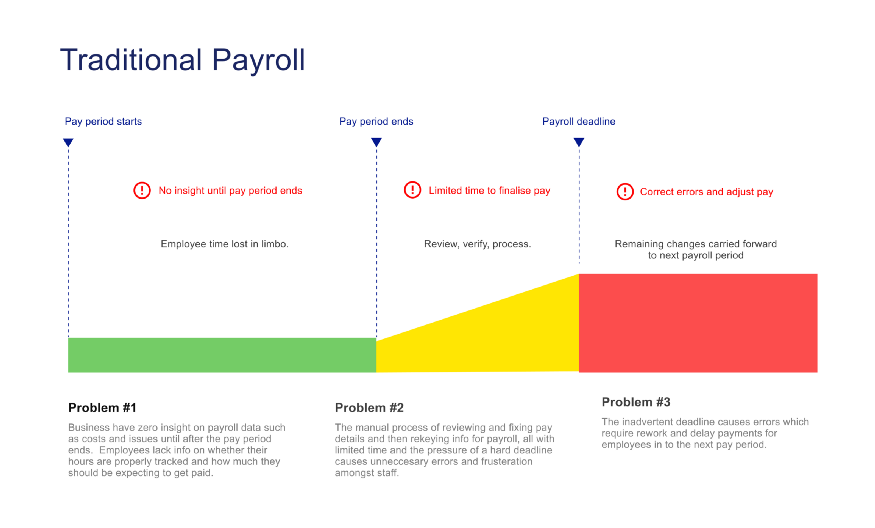

We have identified the three most critical payroll issues of the current payroll model as being:

- Lack of data insight;

- A time consuming manual process; and

- Error and unprocessed data due to inadequate time frame.

Lack of data insight before the pay period

Different organizations have different systems to keep employees’ records. These systems are excellent at keeping track of employees’ data; however, they show no insight about the current costs or any issues until the end of the pay period. Moreover, since employees generally do not have access to this information, they can not verify whether they are properly tracked or how much they are expected to get paid. Consequently, when there is no insight, HR professionals and business administrators only hear of issues after the fact, causing additional manual work that just wastes time and money.

The time-consuming manual process within a limited time frame

Many businesses are moving quickly to automate any manual processes, yet they have not been able to achieve the same results as it relates to payroll. The long manual process starts at the end of each pay period where the payroll department needs time to review the information, fix any necessary details and then submit this information to the payroll provider before the arbitrary cut-off time. The payroll provider then calculates employees’ payroll, withdraws the funds from the business and after 5 days they deposit it into each employees’ account. Yes, it is a very long process. Of course, when things are done manually, it is more likely to produce mistakes and errors.

Errors and unprocessed data due to inadequate timeline

Besides the long manual process, the payroll system also pressures the department to finish their work within a tight time constraint. Most pay periods end on Friday, or even Sunday for some businesses and the payroll department needs to submit this information by 12:00 PM or maybe 5:00 PM on Monday to ensure that the payroll provider deposits money to the employees’ accounts in-time. They only have less than one day to review and correct all the information.

Under unreasonable pressure to do something fast, mistakes and errors are more prone to happen. After receiving an incorrect payment, the employee has to notify the department. HR and payroll efforts are now focusing on fixing mistakes. Unprocessed data is being carried forward to the next pay period and the employee has to wait for another two weeks to get paid in full.

This vicious cycle continues to repeat every two weeks. As a result, instead of prioritizing improved sales and profit, businesses have to spend time and money on fixing mistakes that should not be happening in the first place. This process creates inconveniences for the department and unnecessary frustration amongst the employees.

Every year, businesses spend billions of dollars to administer payroll and bandage the existing payroll issues, from calculating hourly wages, entering data in different software systems, and constantly double-checking just to make sure that it’s right. However, the process gets more complicated and businesses end up losing more money because of penalties for errors that happen as a result of trying to perform all the manual work in such a short time frame.

For all of the above payroll issues, we believe the current payroll process is broken. Businesses need to find another approach to payroll or they will continue to waste time and money chasing inefficient processes that not only affect the bottom line but put their employees at financial risk. As we have seen with the impact of COVID-19, many businesses and individuals are ill-prepared for any sort of financial hiccup and preparing for a softer landing is now front and center for most, if not all people.

Are you interested in a new payroll approach to save time and money? Check out our website and learn more about how Rivvi’s Autonomous Payroll Platform can help improve your bottom line.

0 Comments

Leave A Comment